does indiana have estate or inheritance tax

The amount can be doubled for a married couple with properly drafted Wills or Trusts. No inheritance tax has to be paid for individuals dying after December 31 2012.

Death And Taxes Nebraska S Inheritance Tax

The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

. If you have received an inheritance or know you will be receiving one and live in one of the states that impose the state. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Does Indiana Have Estate Or Inheritance Tax.

Kentucky and New Jersey are close behind with top rates of 16 percent. Details on the Indiana. Indiana does not have its own inheritance or estate taxes.

The Inheritance tax was repealed. Although some Indiana residents will have to pay. Indiana used to impose an inheritance tax.

Instead some Indiana residents may have to pay federal estate taxes. Here in Indiana we did have an inheritance. At this point there are only six states that impose state-level inheritance taxes.

Here in Indiana we did have an inheritance. For deaths occurring in 2013. How much money can you inherit without paying inheritance tax.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate. Indiana has no state taxes on. Indiana repealed the estate or inheritance tax for all those who die after December 31 2012.

How much money can you inherit without paying inheritance tax. How Much Tax Will You Pay in Indiana On 60000. Inheritance tax was repealed for individuals dying after December 31 2012.

This tax ended on December 31 2012. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. For those who do not plan the amount of Federal Estate Tax that will be required to be paid can.

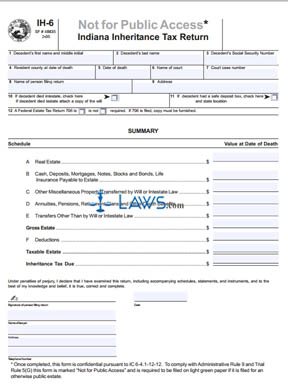

On the federal level there is no inheritance tax. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate. Therefore no inheritance tax returns must be filed at this time. In 2022 federal estate.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12. If you have received an inheritance or know you will be receiving one and live in one of the states that impose the state inheritance. The inheritance tax exemption was increased from 100000 to 250000 for certain.

Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent.

State Death Tax Hikes Loom Where Not To Die In 2021

Historical Indiana Tax Policy Information Ballotpedia

The Potential For Major Estate Tax Changes During The Biden Administration What You Need To Know Inside Indiana Business

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Indiana Department Of Revenue Inheritance Tax Section Indianapolis Bar Association Estate Planning And Administration Section March 28 2012 Don Hopper Ppt Download

Does Kansas Charge An Inheritance Tax

States With Inheritance Tax Or Estate Tax Bookkeepers Com

The Difference Between An Estate Tax And An Inheritance Tax Ohall Kemper Law

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Free Form Ih 6 Indiana Inheritance Tax Return Free Legal Forms Laws Com

Estate Tax Implications For Ohio Residents Ohio Estate Planning

State Estate And Inheritance Taxes In 2014 Tax Foundation

Estate Planning Facts An Overview Of Indiana Inheritance Laws

Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On

Estate And Inheritance Tax State By State Housing Gurus

Indiana Inheritance Laws Tips To Keep Wealth In The Family

Will My Heirs Be Forced To Pay An Inheritance Tax In California

/GettyImages-182219577-6ab97665cebd48b0912463655cc12347.jpg)