how to calculate nj taxable wages

Ad Use Our Free Powerful Software to Estimate Your Taxes. 2022 Taxable Wage Base UI and WFSWF - workers and employers TDI employers.

Aatrix Nj Wage And Tax Formats

O You can exclude from New Jersey Gross Income Tax the same pay that is excluded for federal income tax purposes using the federal definitions of combat zone pay.

. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey State Income Tax Rates and Thresholds in 2022. Under the FLSA these rates may be found at 29 USC.

New Jerseys credit will be the lower of what New Jersey taxes the double-taxed income or what New York taxes the double-taxed income. Payroll So Easy You Can Set It Up Run It Yourself. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in New Jersey. Figure out your filing status. New Jersey Income Tax Calculator 2021.

Taxes Paid Filed - 100 Guarantee. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator. Amounts received as early retirement benefits and amounts reported as pension on Schedule NJK-1 Partnership Return Form NJ-1065 are also taxable.

In New Jersey unemployment taxes are a team effort. Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from the private sector and Keogh plans. 151900 In accordance with NJAC.

New employers pay 05. You must report all payments whether in cash benefits or property. Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

This prorate is New Yorks tax on the double-taxed income. Rates range from 05 to 58 on the first 39800 for 2022. The New Jersey tax calculator is updated for the 202223 tax year.

201 et seq and 29 CFR Part 531. This calculator can determine overtime wages as well as calculate the total earnings for tipped employees. Ad Easy To Run Payroll Get Set Up Running in Minutes.

How to Calculate Withhold and Pay New Jersey Income Tax Withholding Rate Tables Instructions for the Employers Reports Forms NJ-927 and. The actual amount of tax taken from an employees paycheck is also dependent on their filing status single or married and number of allowances both of which are reported on the employees W. Taxable Retirement Income.

We dont make judgments or prescribe specific policies. Important note on the salary paycheck calculator. 1256-8 1256-13 and 1256-14.

Both employers and employees contribute. 1216-48 the following are the calculated dollar equivalents for board and room meals and lodging furnished by employers in lieu of money wages paid for. However if you do not have withholdings or enough withholdings taken out of a paycheck you may have to make estimated payments.

00 hours 725. If you estimate that you will owe more than 400 in New Jersey Income Tax at the end of the year you are required to make estimated payments. This income tax calculator can help estimate your average income tax rate and your take home pay.

The NJ Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NJS. See what makes us different. The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income.

The New Jersey income tax calculator is designed to provide a salary example with salary deductions made in New. After a few seconds you will be provided with a full breakdown of the tax you are paying. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Taxes Paid Filed - 100 Guarantee. Unemployment Insurance UI.

The calculator on this page is provided through the ADP. Payment of employees portion of federal or state income tax Social Security tax or. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

00 hours 725. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. Also make sure that when you are in the New Jersey return you have reviewed the screen About this W2 income.

If youre a new employer youll pay a flat rate of 28. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Rates for board and room meals and lodging under the New Jersey Wage and Hour laws or regulations may be found at NJAC. Details of the personal income tax rates used in the 2022 New Jersey State Calculator are published below the. So the tax year 2022 will start from July 01 2021 to June 30 2022.

39800 2022 Taxable Wage Base TDI FLI workers only. 2020 Tax Rate Increase for income between 1 million and 5 million. Wages include salaries tips fees commissions bonuses and any other payments you receive for services you perform as an employee.

The wages you report for federal tax purposes may be different than the wages you report for New Jersey purposes.

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Aatrix Nj Wage And Tax Formats

What A National 15 Minimum Wage Actually Means In Your State Mark J Perry Map Cost Of Living Infographic

New Jersey Nj Tax Rate H R Block

Pay Stub Templates 10 Free Printable Word Excel Pdf Science Words Templates Words

2021 New Jersey Payroll Tax Rates Abacus Payroll

Five States Ca Nj Ri Ny Hi Offer Paidleave For Temporary Disability Learn More In A New Report Family Medical Medical Leave Medical

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Free New Jersey Payroll Calculator 2022 Nj Tax Rates Onpay

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

What N J Towns Are The Most Affordable To Live In Nj Com

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

1099 R Software To Create Print And E File Irs Form 1099 R Irs Irs Forms W2 Forms

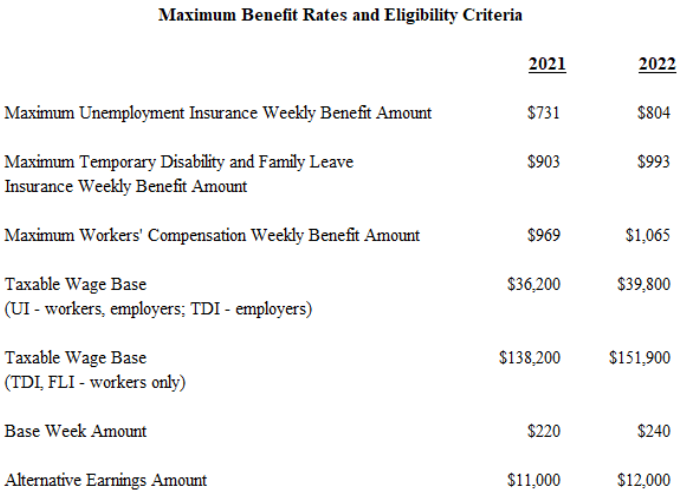

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

Aatrix Nj Wage And Tax Formats

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return